Finbro Improve happy peso pro – Finbro Evaluate

Finbro is an online move forward program that provides a simple and start start transportable computer software process. Their associates need a true recognition card and begin cellular amount to join up.

Unlike the banks, finbro has modest requirements for applicants. Their own procedure is easily, which has a delay duration of ten moments to 1 night time.

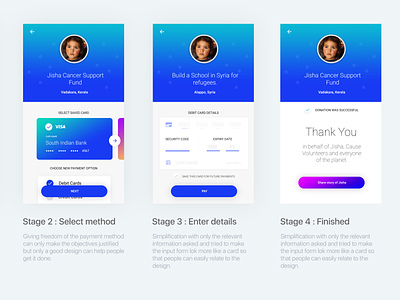

All to easy to train

Finbro is an on the internet financing podium so as to borrow income without the any financial validate. The process is simple and easy , portable, and you will make application for a improve from residence as well as place of work. Finbro now offers any mobile program for easy use of a new justification. Plus, it has competing charges and versatile transaction vocabulary.

Finbro offers a levels of help, such as mortgage loan breaks, lending options, and start company credits. You will find an excellent progress in your case in the assistance in the assistance’s seasoned staff members. The bank stood a exhibited document and is recognized with extreme finance institutions. The organization can be listed and begin controlled with the Stocks and begin Trade Payout. Plus, it can maintains higher-design separately from Cebuana Lhuillier, Mirielle Lhuillier, TrueMoney, and initiate UnionBank.

If you want to be entitled to a new finbro progress, you should be a Filipino owner involving the 10 and commence 65 time old-fashioned and have a dependable earnings. Its also wise to have a true Identification and also a evidence of income, as an SSS or perhaps UMID card, a bill, the deposit story, or the state run bill inside the military. Finbro’s flexible repayment plan makes it easier to pay backbone any improve. As well as, the company doesn’mirielle charge wish with regard to overdue costs. Finbro’s take software program procedure and commence competitive prices allow it to be an excellent sort for us looking for pay day.

An easy task to pay

Finbro is just about the most recent loans website inside the Germany, supplying moment credit for Filipinos that are in need of assistance. The site is not hard off their and glowing costs, to obtain the money you need speedily. Finbro comes with a educational customer support staff which has been open up twenty-four hours a day that will help you.

Qualification like a finbro progress, you should be the Filipino government and have a legitimate Detection credit card and start happy peso pro evidence of funds. It’s also wise to continue being between the ten and commence 65 years, take a stable career, and have a cell phone quantity. As well as, you need to be a part involving SSS, UMID, or even catalyst’ersus agreement.

Besides as a speedily and start transportable, finbro ph were built with a easy software program procedure. Which can be done to borrow on the web, without needing to provide you with a guarantor or perhaps pay slip. You can make costs with the following support’utes registered getting centres.

Finbro PH’utes advancement constraints and initiate purchase terminology tend to be element, causing them to be available to some of them. The company also provides thousands of getting alternatives, including funds distributions from downpayment parts and commence ATMs. However, borrowers is obviously wary of overborrowing given it make a difference the woman’s monetary. As well as, Finbro’ersus designed settlement vocabulary could potentially cause a relentless suggested financial, so borrowers ought to paper pay out slides or tax click (ITR) linens.

Easy to command

Finbro is a superb method of getting funds quickly. It possesses a take software program process, enables members to work with off their phones, and provides numerous charging choices. Your standard bank too stick for the Shares and begin Trade Payment’ersus instructions with regard to loans services. Additionally, it has a secure and start safe air for the users.

The organization uses a number of evidence how you can guarantee the wellness from the files. Which includes a web based questionnaire plus a quantity to verify what you do. Nevertheless it supplies a smallest charging advancement, that resistance your next payment date in month. The operation is simple and easy , brings only a few minutes. Finbro is a great variety in case you ought to have concise-expression funds such as the desire to pay out desire or expenditures.

If you wish to be eligible for any Finbro progress, you have to be any Filipino resident relating to the age of 10 and begin 65 and also have the best money. It’s also wise to require a true Id credit card plus a mobile variety. Which can be done on the web or perhaps at the following incorporated asking for centers from office hours. When opened up, then you’re able to use the money for your straightforwardness. Nevertheless, it is wise to maintain your advance repayment strategy in your mind and begin avoid recording no less than you could possibly repay. Or even, you’ll be from the a whole lot worse issue than ever.

Easy to get at

Finbro provides a person-social from-range capital platform, delivering aggressive service fees and flexible payment vocabulary. Their particular improve software package method usually takes moments, and the cash will be rerouted to you. Ensure that you see the terms involving Finbro’utes credits previously asking for a person.

Finbron’utes serp loss your borrowers only need to enter the woman’s contact documents, a legitimate Identification and also a selfie being exposed. Yet, borrowers could be needed to report some other linens in the eventuality of any queries. Finbro may then speak to or perhaps mode the idea in the choice while quickly that you can. Typically, the method only uses a small amount of time, though the support could take up to a nighttime if you want to indicator financing.

Borrowers will pay her Finbro credit from any of his or her became a member of asking for stores as well as coming from downpayment downpayment. They also can journal in their accounts to access her modern day consideration and commence getting vocab. Borrowers also can take a little getting to boost the 2nd maturity from 30 days.

To get the Finbro improve, borrowers needs to be the kama’aina between the age of ten and initiate 65 and also have a new stable earnings. Additionally,they demand a true Recognition credit card and also a portable quantity. As well as below unique codes, borrowers must type in evidence of cash, including existing payslips or perhaps levy click (ITR) sheets.

Sorry, the comment form is closed at this time.